A LONG HISTORY OF DATA

At WestEnd Advisors, data drives all of our investment strategies. We analyze hundreds of sources of macroeconomic information and use what we discover to inform our decisions. Our proprietary, top-down investment process has been implemented with individual stocks since 1996 and with ETFs since 2005.

Active strategies based on macroeconomic analysis and conviction

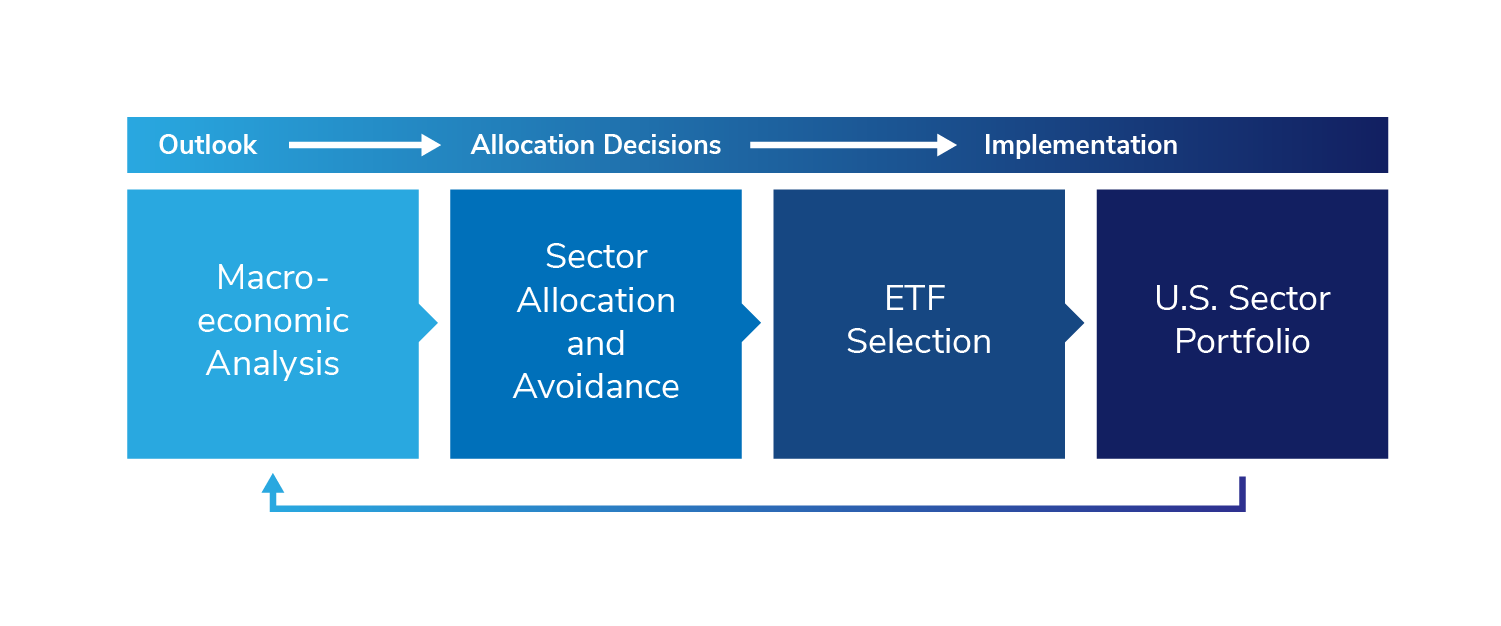

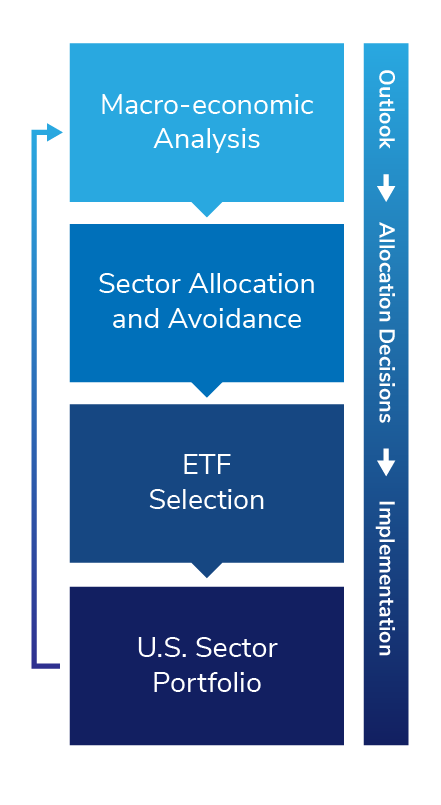

DOMESTIC Strategy

U.S. Sector

Employs high-conviction sector allocation and avoidance driven by macroeconomic analysis.

Objective

Seeks to provide long-term capital appreciation and mitigate volatility by combining high-conviction active management with the diversification of ETFs. The strategy invests in sectors of the S&P 500 that are primed for growth, while avoiding those facing economic headwinds.

Portfolio Model Allocations*

- Information Technology

- Financials

- Health Care

- Communication Services

- Consumer Discretionary

- Consumer Staples

U.S. Sector Strategy

Number of holdings: Typically 4-6 U.S equity sector exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

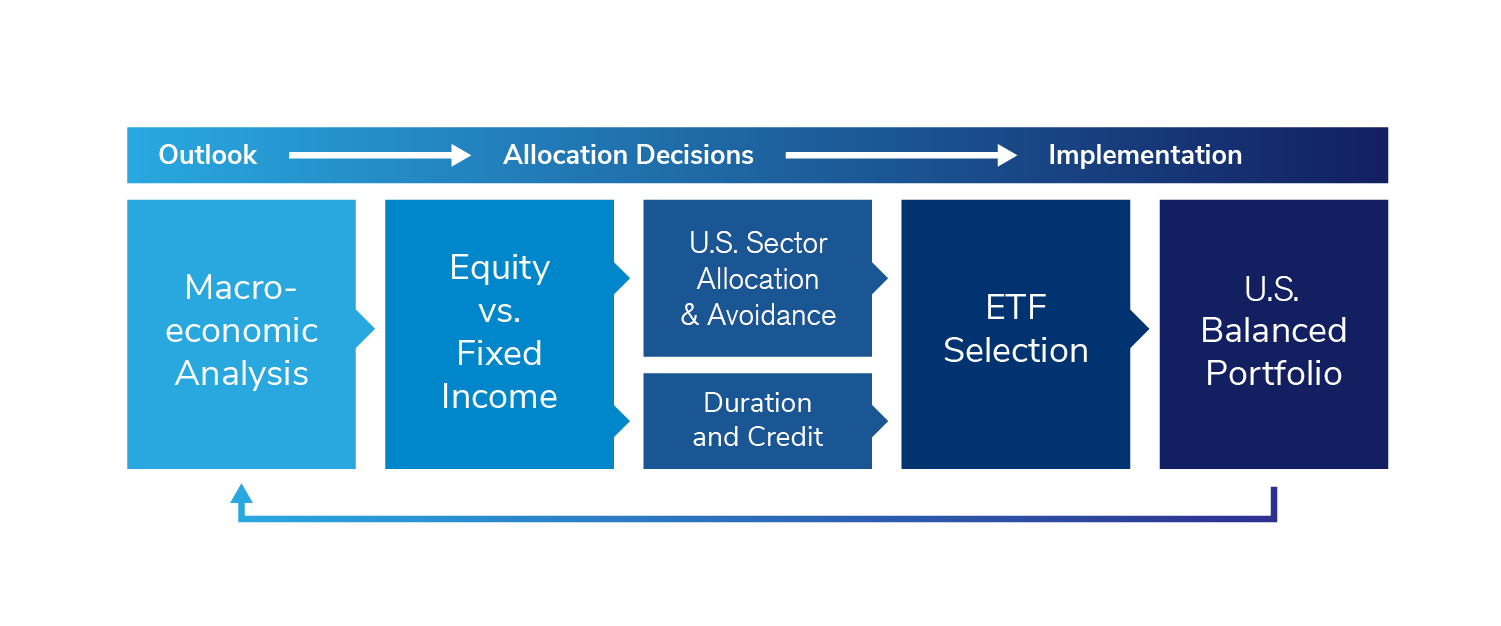

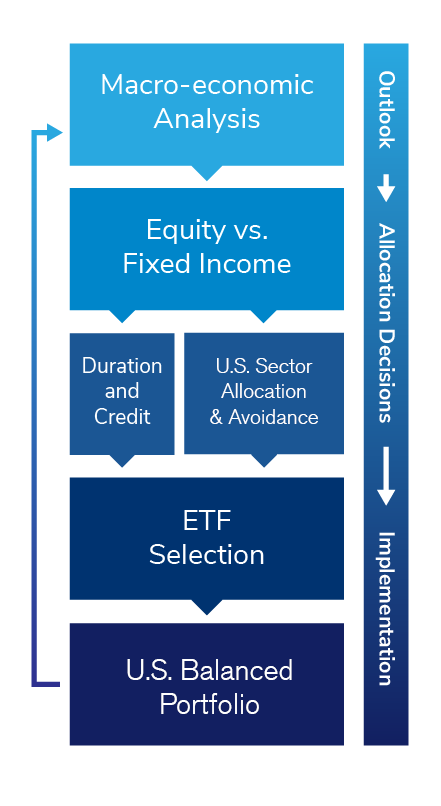

DOMESTIC Strategy

U.S. Balanced

Blends U.S. equity growth potential with U.S. fixed income for stability.

Objective

Seeks long-term capital appreciation while preserving capital through asset class diversification. The long-only strategy exploits domestic opportunities in the U.S. equity and U.S. fixed income markets, combining high-conviction active management with the diversification of ETFs from leading U.S. providers.

Portfolio Model Allocations*

- U.S. Large-Cap Equity

- Fixed Income

U.S. Balanced Strategy

Number of holdings: Typically 7-12 equity and fixed-income exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

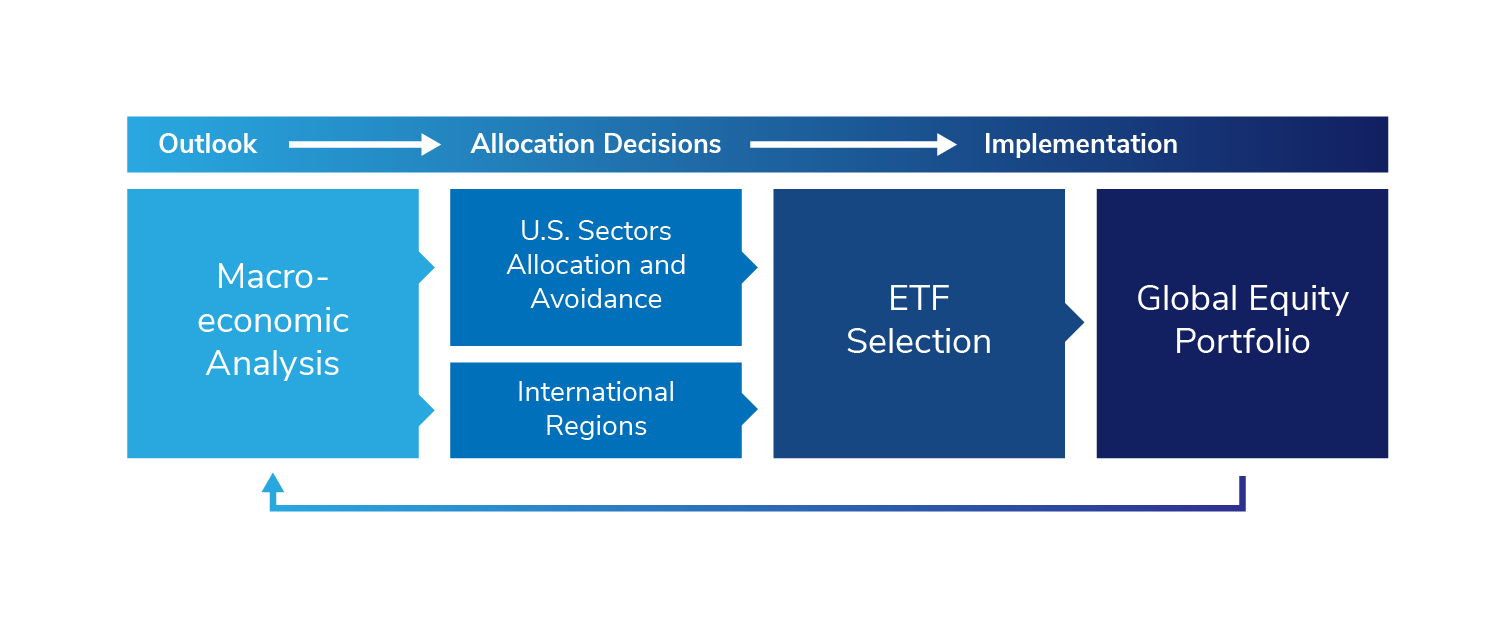

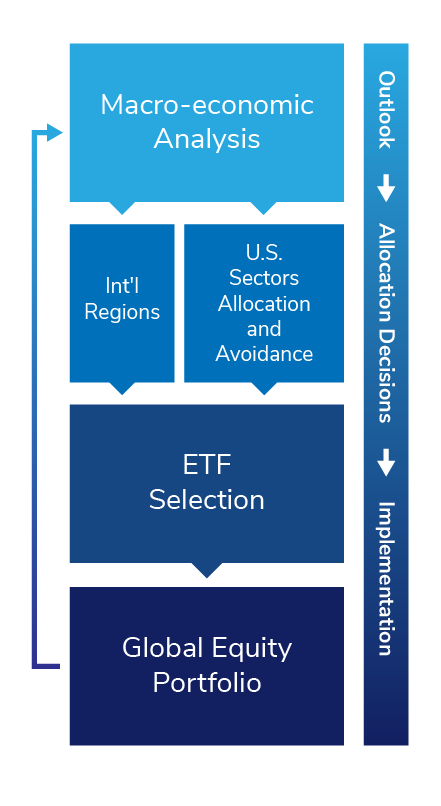

Global Strategy

Global Equity

Employs active allocation across global equity markets in pursuit of long-term capital appreciation.

Objective

Seeks long-term capital appreciation while mitigating volatility. The long-only, low-turnover strategy combines high-conviction active allocations to global and U.S. equities with the diversification of ETFs from leading U.S. providers.

Portfolio Model Allocations*

- U.S. Large-Cap Equity

- International Equity

Global Equity Strategy

Number of holdings: Typically 5–10 equity exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

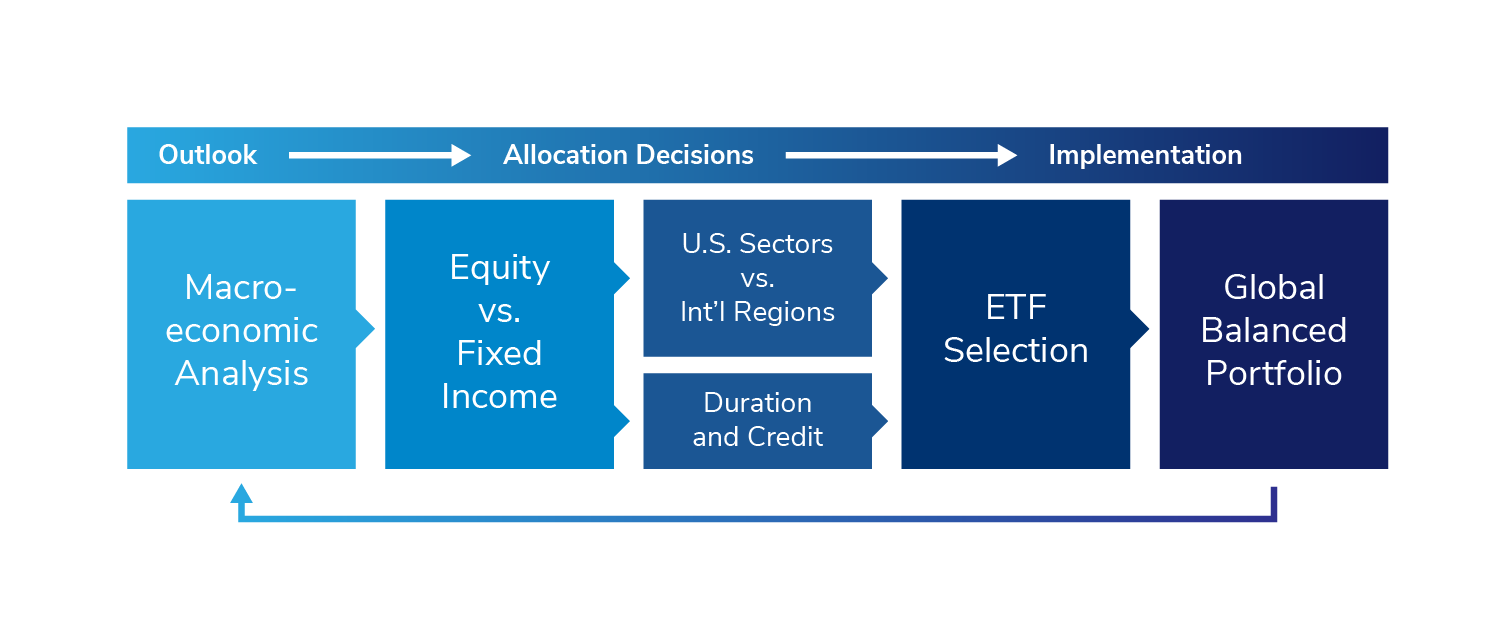

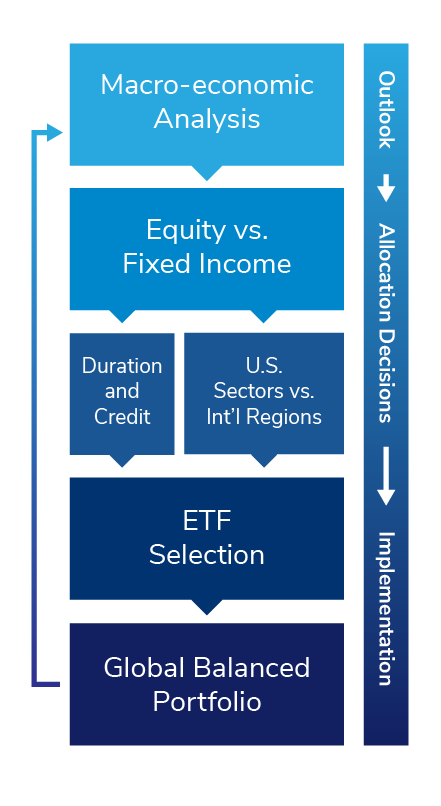

Global Strategy

Global Balanced

Blends global equity growth potential with U.S. fixed income for stability.

Objective

Seeks long-term capital appreciation while preserving capital through asset class diversification. The long-only strategy exploits opportunities in the global equity and U.S. fixed income markets, combining high-conviction active management with the diversification of ETFs from leading U.S. providers.

Portfolio Model Allocations*

- U.S. Large-Cap Equity

- International Equity

- Fixed Income

Global Balanced Strategy

Number of holdings: Typically 8-15 equity and fixed-income exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

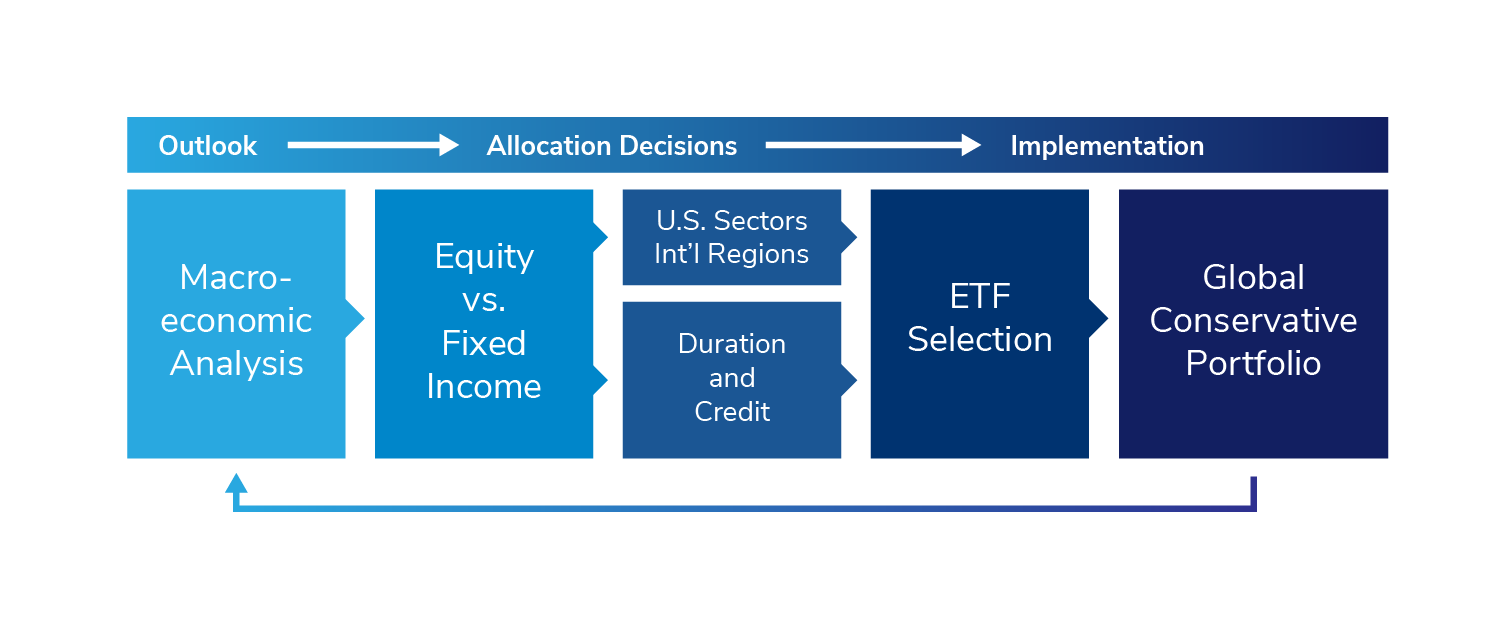

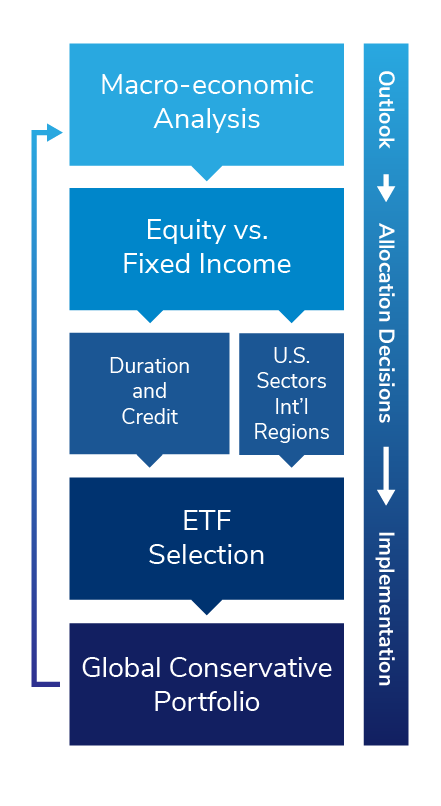

Global Strategy

Global Conservative

Emphasizes capital preservation through an active fixed-income allocation with growth potential from global equities.

Objective

Seeks capital preservation through asset class diversification and fixed-income exposure as well as capital appreciation through active allocations. The long-only, low-turnover strategy combines high-conviction active management with the diversification of ETFs from leading U.S. providers.

Portfolio Model Allocations*

- U.S. Large-Cap Equity

- International Equity

- Fixed Income

Global Conservative Strategy

Number of holdings: Typically 8-17 fixed-income and equity exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

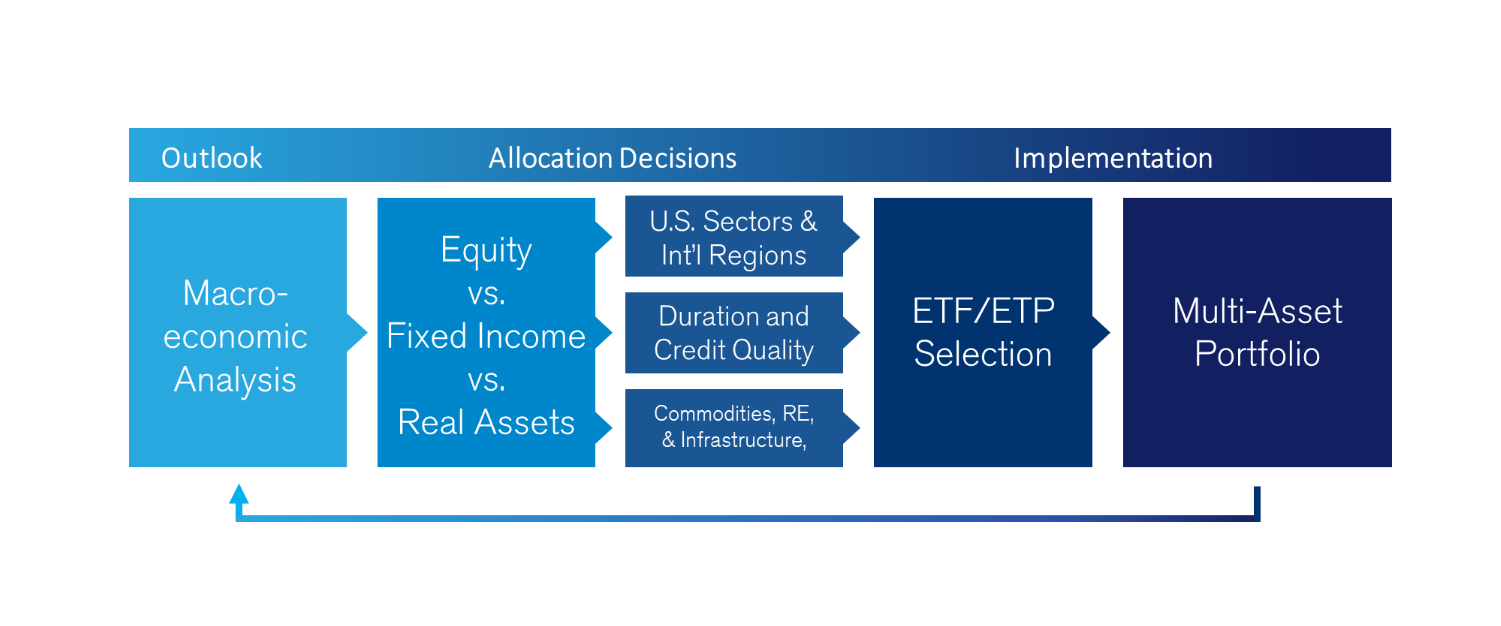

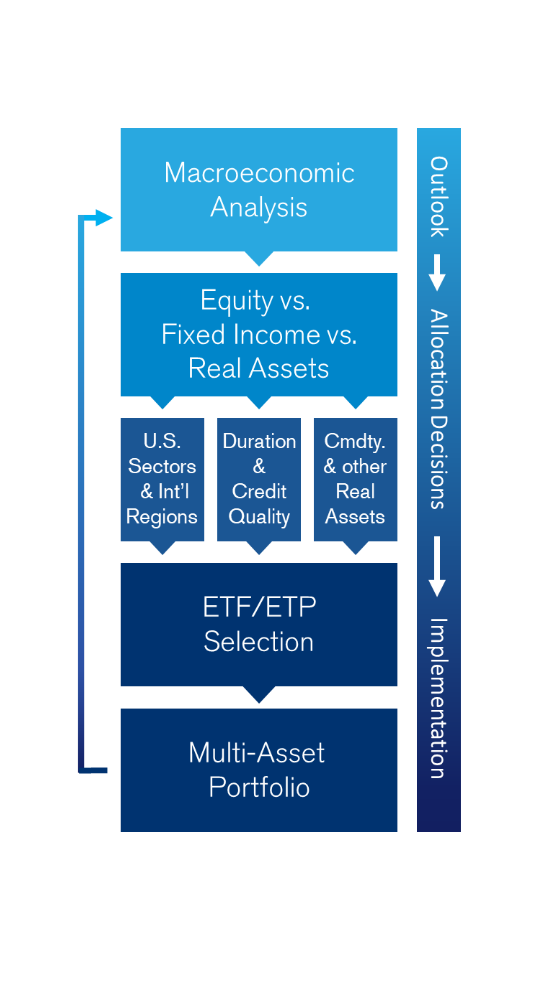

Multi-Asset

Multi-Asset

An active, multi-asset solution for investors seeking capital appreciation with risk mitigation from asset class diversification.

Objective

Primarily seeks capital appreciation across a range of economic environments through active allocations to and within equity, fixed income, and real asset exposures. This multi-asset class strategy combines high-conviction active management with the diversification of low-cost, passive exchange-traded products.

Portfolio Model Allocations*

- U.S. Large-Cap Equity

- International Equity

- Fixed Income

- Real Assets

Multi-Asset Strategy

Number of holdings: Typically 8-22 equity, fixed-income, and real asset exchange-traded funds

Quarterly portfolio outlook, positioning, and attribution

Portfolio positioning intra‐quarter updates

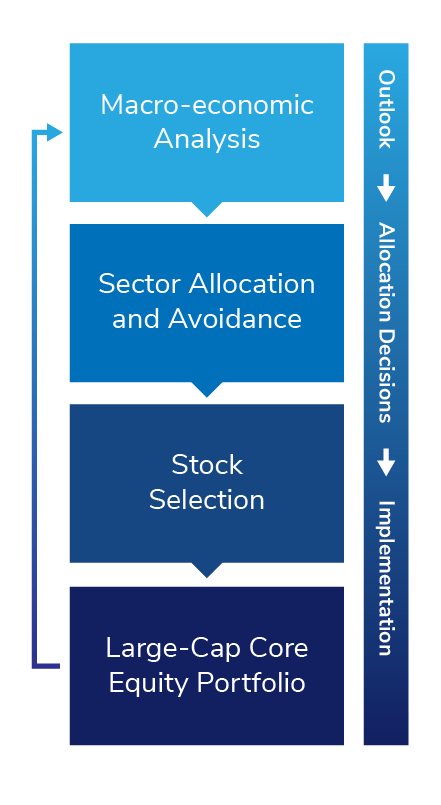

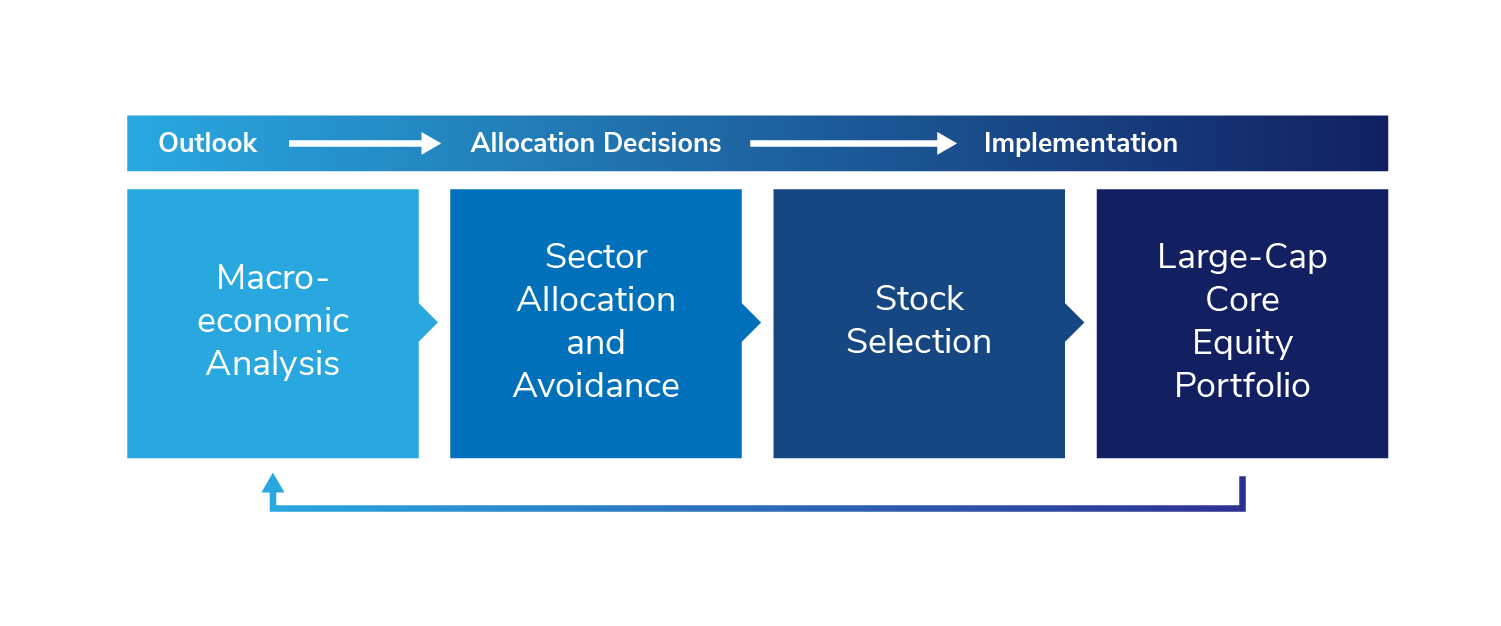

DOMESTIC Strategy

Large-Cap Core Equity

Combines high-conviction sector allocation and avoidance with active stock selection.

Objective

Seeks to provide long-term capital appreciation and minimize periods of significant negative returns. Employing a sector-focused, data-driven approach, we invest in financially strong S&P 500 companies in the sectors best positioned to benefit from economic tailwinds.

Portfolio Model Allocations*

- Information Technology

- Financials

- Health Care

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Real Estate

Large-Cap Core Equity Strategy

Number of holdings: Approximately 20 large-cap U.S. stocks